b&o tax wv

Charleston West Virginia is a great place to live work and play. The City of Clarksburg has business and occupation tax charged on gross revenues of every entity conducting business within the corporate limits of this.

Business Occupation Tax Clarksburg Wv

Municipalities that do not impose.

. Schedule I-EPP Industrial Expansion or. BO Tax is measured by the application of rates against values of products gross proceeds of sale or gross income of the business as the case may be. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization.

Tax Return Form Businesses choose. They worry the next possible one might devastate them. Our City is always growing so use the information here to assist you.

B O Tax. BOT-300G Tax for Gas Storage. City of Fairmonts ordinance number 1655 with an effective date of October 8 2015 provides for the imposition administration collection and enforcement of a Consumers Sales and Service.

Business Occupation Tax. The BO tax cut will hurt West Virginia cities. Gross income or gross proceeds of sales derived from sales within West.

EOTC-1 Schedule EOTC-1 Economic Opportunity Tax. For Investments Placed Into Service On or After January 1 2003. Business and Occupation Tax BO All persons engaging in business activities within the city limits are required to file a quarterly Business and Occupation BO tax return.

The main revenue source for West Virginia cities is the business and occupation tax generated by any commercial activity locate within the City limits. States of Washington West Virginia and as of 2010 Ohio and by municipal. BOT-300F Tax Return for Synthetic Fuels.

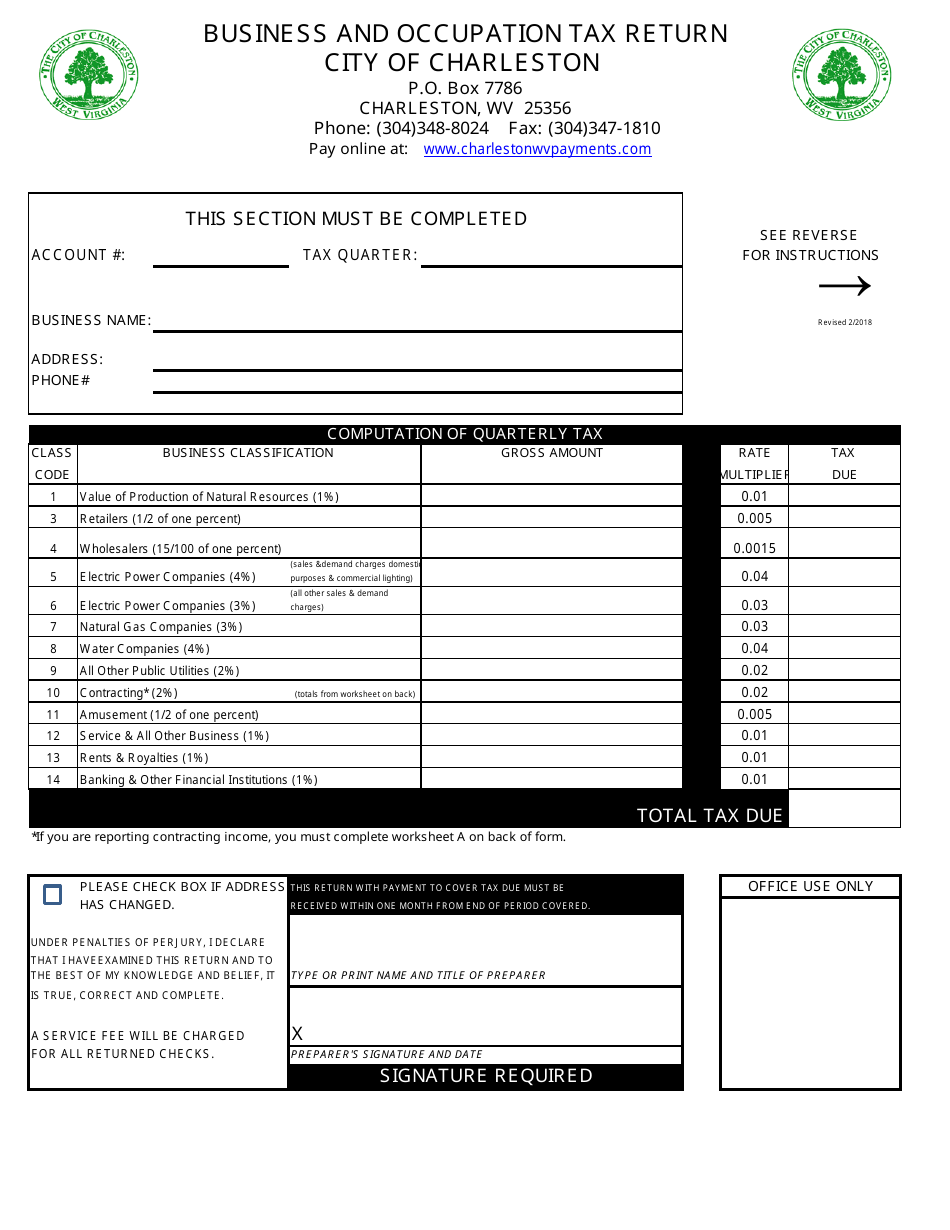

The City of Charleston broadly imposes a Business and Occupation BO. Any business that is engaged in or caused to be engaged in activities with the object of gain of economic benefit either direct or indirect must fill out the Business and Occupation BO Tax. The Citys B O Tax is based on the gross income gross receipts of each.

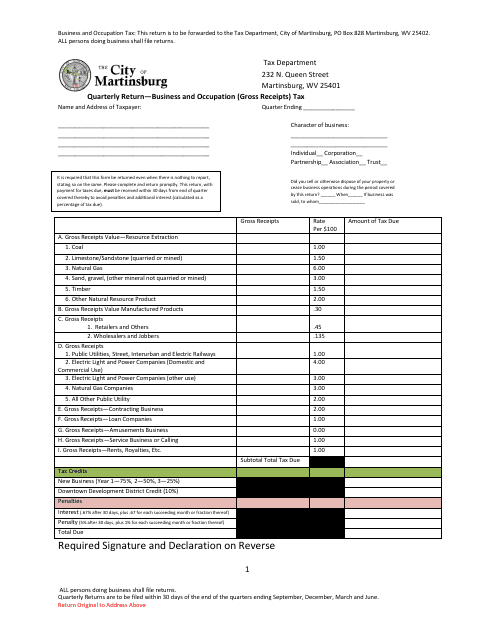

This tax is collected from anyone conducting business within the corporate limits of the City of Martinsburg. Tax Information and Assistance. Business and Occupation BO taxes are due twice a year January and July.

Washington unlike many other states does not have. There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount. The following general principles determine tax liability under the municipal BO Tax.

The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US. The city is currently in the process of developing an online method for paying your BO taxes that. BUSINESS OCCUPATION TAX OVERVIEW.

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by. The West Virginia Municipal Business and Occupation Tax BO Tax is an annual privilege tax imposed on all persons and entities doing business in West Virginia municipalities. Information on BO Taxes for Charleston WV.

Determine you Charleston BO taxable gross income for each of the classifications and enter it. Of these 117 impose a business and occupation tax in some form and the other 117 municipalities do not impose a business and occupation tax. The state BO tax is a gross receipts tax.

EOTC-A Application for West Virginia Economic Opportunity Tax Credit. All persons engaging in business. It is measured on the value of products gross proceeds of sale or gross income of the business.

West Virginia lawmakers claim eliminating the income tax will drive. BUSINESS OCCUPATION TAX OVERVIEW. Determine your Business Classifications and corresponding rates from the tax table.

Parkersburg West Virginia Parkersburg B O Railroad Station Parkersburg Parkersburg Wv West Virginia

Wv Cities Worry About B O Tax Cuts

Treasury Business Occupation Tax Bluefield West Virginia

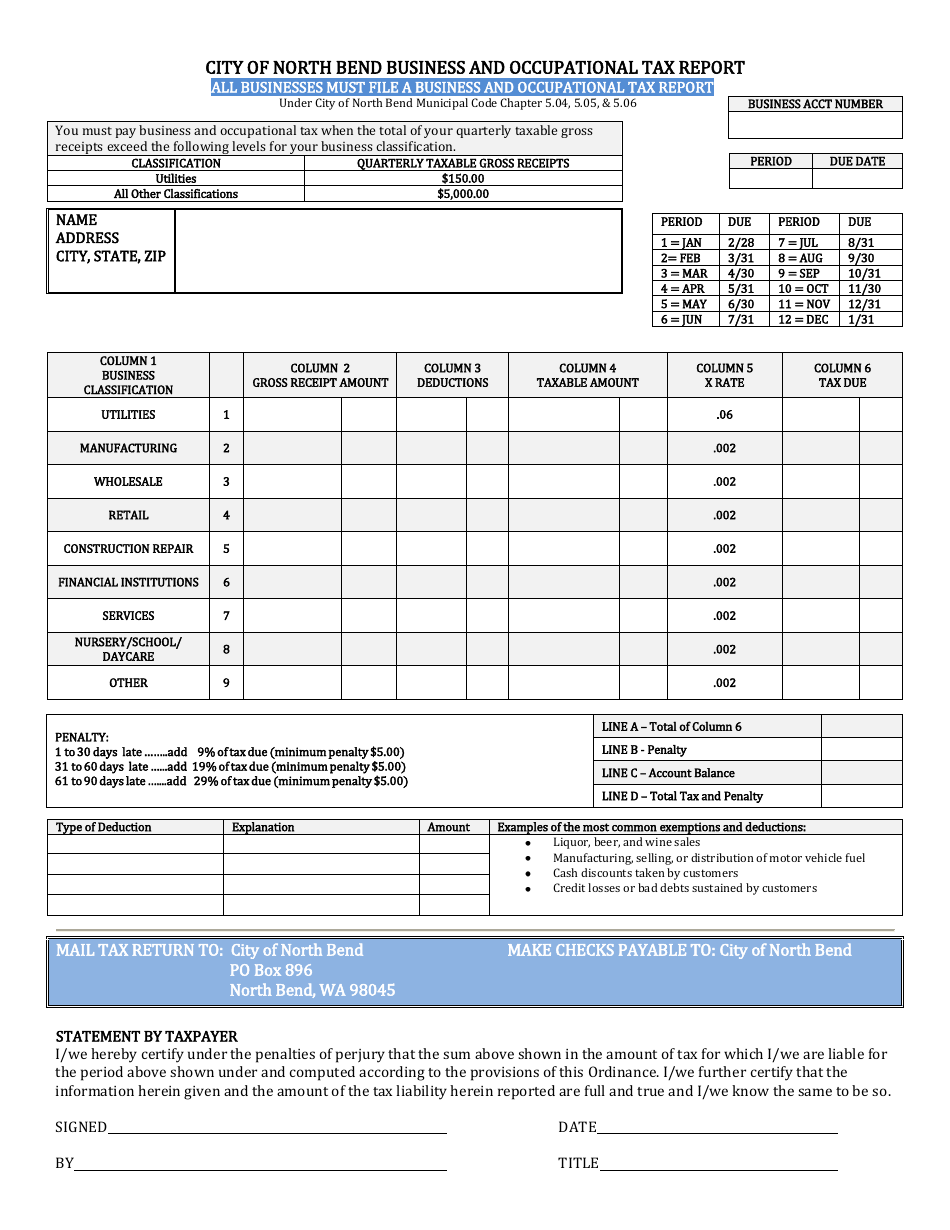

City Of North Bend Washington Business And Occupational Tax Report Form Download Printable Pdf Templateroller

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Wv Cities Worry About B O Tax Cuts

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

West Virginia Quarterly Return Business And Occupation Gross Receipts Tax Download Fillable Pdf Templateroller

Wv Cities Worry About B O Tax Cuts

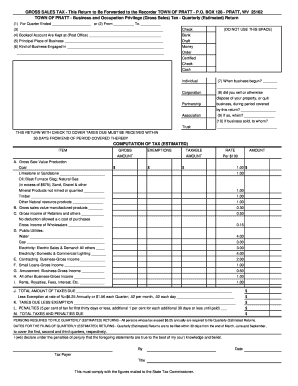

Get And Sign B O Tax Form Town Of Pratt

City Of Buckhannon B O Tax Forms

Wv Gross Sales Tax Fill Out Tax Template Online Us Legal Forms

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller